Paul B Insurance Things To Know Before You Buy

Table of ContentsPaul B Insurance - QuestionsSome Of Paul B InsurancePaul B Insurance Things To Know Before You BuyThe Definitive Guide for Paul B InsuranceThe Ultimate Guide To Paul B InsuranceSome Known Details About Paul B Insurance

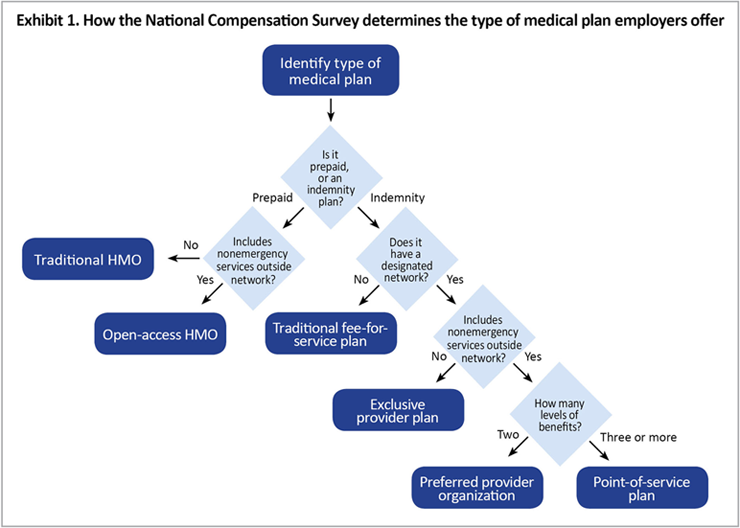

Associated Topics One factor insurance coverage issues can be so confounding is that the healthcare market is frequently changing as well as the insurance coverage plans offered by insurance companies are tough to categorize. In other words, the lines between HMOs, PPOs, POSs and other kinds of insurance coverage are usually fuzzy. Still, comprehending the makeup of different plan types will certainly be handy in evaluating your options.

As soon as the insurance deductible amount is reached, added health expenditures are covered according to the arrangements of the medical insurance plan. An employee could then be liable for 10% of the costs for treatment received from a PPO network company. Deposits made to an HSA are tax-free to the employer as well as employee, and also cash not invested at the end of the year might be surrendered to pay for future medical costs.

The Ultimate Guide To Paul B Insurance

(Employer contributions need to be the very same for all employees.) Workers would be accountable for the initial $5,000 in clinical prices, however they would each have $3,000 in their individual HSA to pay for medical costs (and would have much more if they, too, added to the HSA). If employees or their households tire their $3,000 HSA part, they would pay the following $2,000 expense, whereupon the insurance coverage policy would begin to pay.

There is no limit on the quantity of money a company can contribute to employee accounts, however, the accounts might not be funded through worker salary deferments under a lunchroom strategy. Furthermore, employers are not permitted to reimburse any type of part of the equilibrium to employees.

Do you understand when one of the most wonderful time of the year is? No, it's not Xmas. We're speaking about open enrollment period, child! That's right! The magical season when you reach compare health insurance prepares to see which one is best for you! Okay, you obtained us.

Indicators on Paul B Insurance You Need To Know

When it's time to select, it's crucial to recognize what each strategy covers, exactly how much it sets you back, as well as where you can utilize it? This things can really feel difficult, yet it's easier than it appears. We assembled some functional understanding actions to assist you feel great about your options.

(See what we did there?) Emergency treatment is frequently the exception to the rule. These plans are one of the most prominent for individuals that get their health insurance via job, with 47% of protected workers enrolled in a PPO.2 Pro: The Majority Of PPOs have a suitable choice of carriers to pick from in your area.

Con: Higher costs make PPOs much more expensive than various other kinds of strategies like HMOs. A wellness maintenance company is a health and wellness insurance strategy that generally only covers treatment from doctors that work for (or contract with) that details strategy.3 Unless there's an emergency situation, your plan will certainly not pay for out-of-network care.

Indicators on Paul B Insurance You Need To Know

Even More like Michael Phelps. The plans are tiered according to just how much they cost and also what they cover: Bronze, Silver, Gold and Platinum. (Okay, it holds true: The Cre did have some platinum records as well as Michael Phelps never won a platinum medal at the Olympics.) Secret reality: If you're qualified for "cost-sharing reductions" under the Affordable Care Act, you must choose a Silver strategy or better to obtain those decreases.4 It's good to understand that strategies in every group supply some types of cost-free preventative care, and also some deal free or reduced medical care solutions before you fulfill your insurance deductible.

Bronze plans have the most affordable month-to-month premiums but the highest out-of-pocket expenses. As you function your method up through the Silver, Gold and Platinum classifications, you pay a lot more in costs, but less in deductibles and also coinsurance. As we pointed out link before, the extra costs in the Click Here Silver classification can be decreased if you certify for the cost-sharing reductions.

A Biased View of Paul B Insurance

When picking your medical insurance plan, don't ignore health care cost-sharing programs. These job basically like the various other wellness insurance programs we described currently, yet practically they're navigate to these guys not a kind of insurance policy. Permit us to explain. Health cost-sharing programs still have month-to-month premiums you pay and specified insurance coverage terms.

If you're trying the DIY course as well as have any type of lingering inquiries concerning medical insurance plans, the specialists are the ones to ask. And they'll do greater than simply answer your questionsthey'll also locate you the very best rate! Or possibly you 'd such as a method to combine obtaining wonderful medical care coverage with the possibility to aid others in a time of need.

How Paul B Insurance can Save You Time, Stress, and Money.

CHM aids families share health care expenses like clinical examinations, maternal, a hospital stay and surgical treatment. And also, they're a Ramsey, Relied on companion, so you know they'll cover the clinical bills they're expected to as well as recognize your insurance coverage.

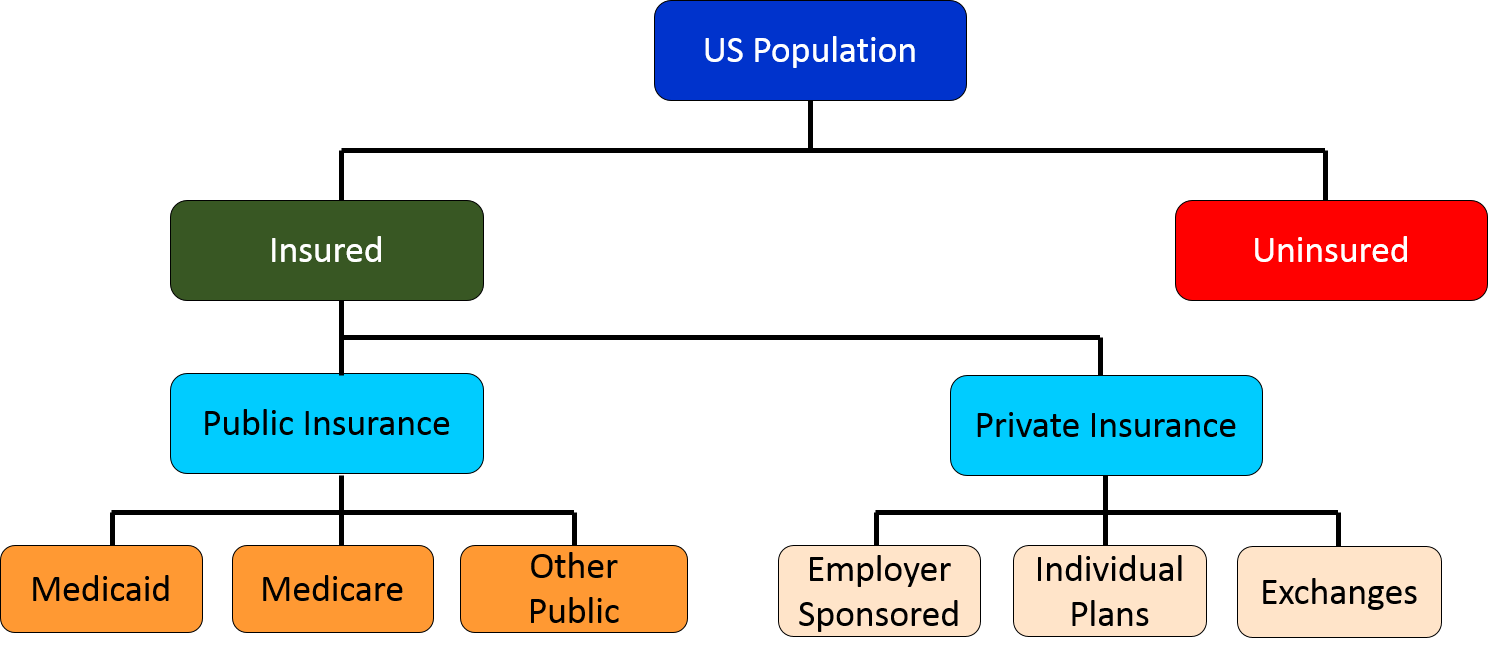

Trick Concern 2 Among the important things health care reform has performed in the U.S. (under the Affordable Care Act) is to present more standardization to insurance plan benefits. Before such standardization, the benefits used diverse dramatically from strategy to strategy. Some plans covered prescriptions, others did not.